The biggest mistake people make with jojoba oil farming is believing that demand alone guarantees profit. On paper, jojoba looks like the perfect crop. It grows in dry areas, needs little water, survives heat, and sells into cosmetic and pharmaceutical markets that talk in dollars, not kilograms. Because of this, thousands of farmers enter jojoba farming with the assumption that low input plus high price equals easy income. That assumption is exactly where losses begin.

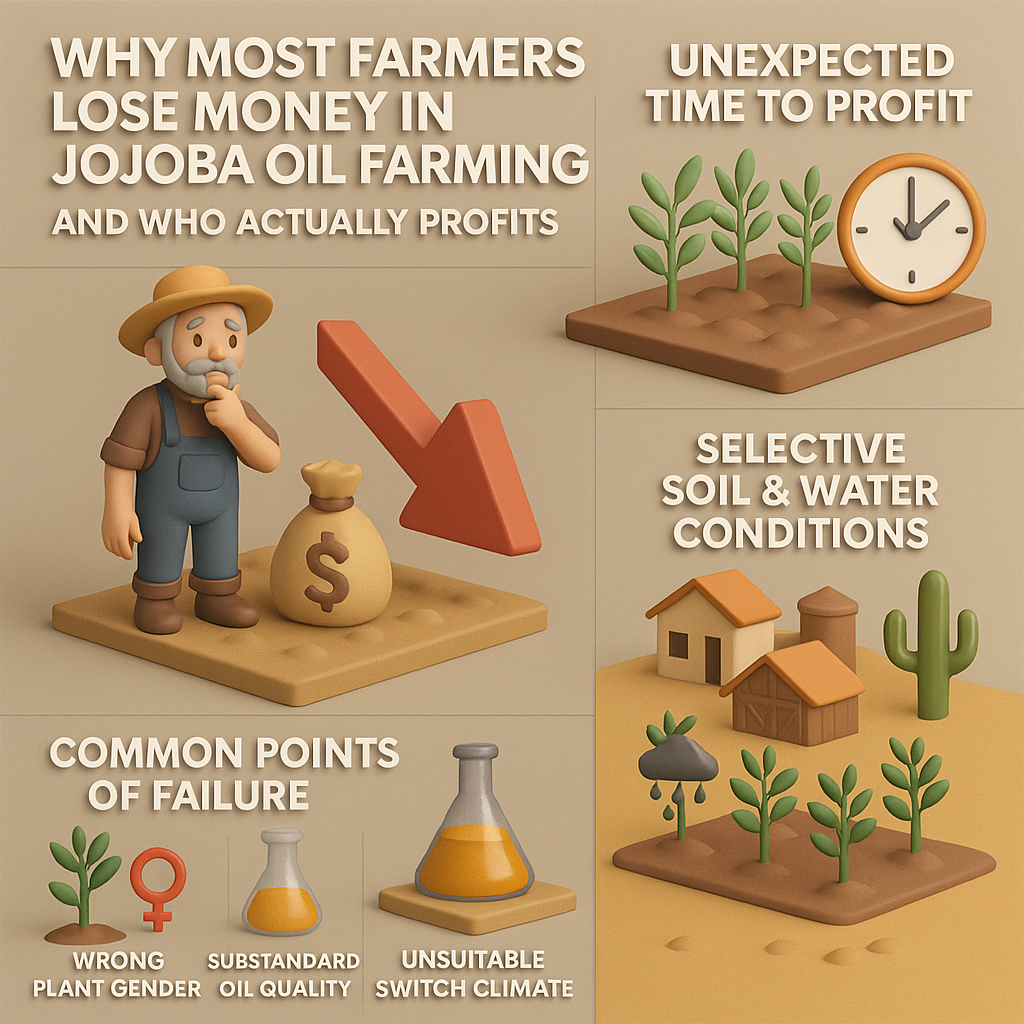

In real fields, the first shock comes after three years. Jojoba is not an annual crop. It is not even a fast-return perennial. It demands patience that many farmers underestimate. For the first two years, there is almost no meaningful income. For some farms, even the third year gives nothing more than scattered flowering and a handful of seeds. Farmers who planned cash flow based on online yield tables often abandon the plantation halfway, selling land or uprooting plants because the waiting period breaks their financial stability. This is the first filter where jojoba eliminates the unprepared.

Another silent failure point appears even before harvest: plant gender. Jojoba is not a simple crop where every plant produces seeds. Male and female plants are separate. Too many farms discover too late that their plantation has the wrong male-female ratio. Nurseries promise “balanced plants,” but field reality is inconsistent. A plantation dominated by male plants looks healthy, green, and strong — yet produces almost no seeds. Farmers who do not inspect flowering patterns carefully lose years before realizing the mistake. Replanting after three or four years is not a small correction; it is a financial reset.

Market reality creates the next layer of disappointment. Online sources talk about jojoba oil prices without explaining quality filters. Cosmetic buyers do not buy “jojoba oil.” They buy a very specific chemical profile. Color, wax ester composition, odor neutrality, filtration clarity, and oxidation stability matter more than volume. Oil extracted from immature seeds or mixed batches is quietly rejected. Buyers rarely explain rejection reasons in detail. They simply stop responding. Farmers then sell oil at a fraction of the expected price to traders who blend it for industrial use. The price difference between cosmetic-grade and industrial-grade jojoba oil is often more than double, yet most farmers only realize this after the first rejection.

Climate suitability is another misunderstood factor. Jojoba survives harsh conditions, but survival is not profitability. In areas with unexpected humidity spikes or unseasonal rainfall, flowering drops sharply. Excess moisture encourages fungal stress that does not kill the plant but reduces seed formation. Yield charts never show this. Fields look fine from a distance, but seed counts per bush remain low. Farmers then assume fertilizer deficiency or irrigation problems, wasting money on inputs that do not address the root cause.

Processing mistakes compound losses. Cold-pressed jojoba oil must be filtered correctly and stored properly. Exposure to light, air, or metal contamination alters its wax structure. Many small units extract oil but fail at post-extraction handling. Oil that looks acceptable locally fails laboratory testing abroad. This is where small producers lose access to export buyers and are forced into domestic bulk markets with thin margins.

Another uncomfortable truth is scale. Jojoba farming works best either at very small, controlled experimental scale or at large, professionally managed plantations. Mid-scale farms suffer the most. They carry enough cost to feel pressure but not enough volume to negotiate better prices or invest in proper testing and certification. This middle zone is where optimism dies quietly.

Who should not do jojoba farming becomes clear once these realities are visible. Farmers who need yearly income should avoid it. Those who rely on seasonal crop rotation for cash flow should not lock land into a slow-return perennial. Farmers without access to reliable nurseries or testing facilities are gambling, not farming. On the other hand, jojoba suits landholders with long-term vision, stable external income, desert or semi-arid land unsuitable for food crops, and access to professional buyers before planting begins.

Where jojoba truly works is often invisible online. It works in regions where land has little alternative value, where water scarcity already limits crop options, and where growers treat jojoba as an asset rather than a crop. Successful jojoba farmers think like orchard managers, not seasonal growers. They plan five to seven years ahead. They budget losses before profits. They secure buyers before harvest. They understand that oil rejection is part of the learning curve, not a personal failure.

The biggest illusion surrounding jojoba is that it is “easy desert money.” It is not. It is slow, selective, and unforgiving to impatience. But when done correctly, by the right person, in the right place, with realistic expectations, it becomes one of the few oil crops that can convert marginal land into long-term value without exhausting soil or water.

FAQs — Real Questions Farmers Actually Ask

Is jojoba profitable everywhere? No. Survival is common; profitability is selective and location-dependent.

How long before real income starts? Usually four to five years, sometimes longer.

Why does oil get rejected even when yield is good? Because buyers judge chemical quality, not volume.

Can small farmers succeed? Only if they control quality tightly or join serious cooperatives.

Is irrigation necessary? Yes, but over-irrigation causes more loss than drought.

Final Judgment

Jojoba oil farming is not a shortcut crop. It is a long-term land strategy. If you enter it for fast returns, it will punish you quietly. If you enter it with patience, capital discipline, and market clarity, it can reward land that nothing else values. Most failures happen not because the crop is bad, but because expectations are wrong.

Most agricultural oils compete on volume. Jojoba oil competes on compatibility with human biology. That single difference explains why jojoba oil commands a price that many farmers and processors do not initially believe.

Despite being called an oil, jojoba oil is chemically closer to a liquid wax ester. This structure closely resembles human skin sebum. Because of this, global cosmetic and pharmaceutical industries use jojoba oil not as a flavor, fuel, or cooking fat, but as a functional ingredient that stabilizes formulations, extends shelf life, and reduces allergic reactions.

The value of jojoba oil does not come from yield alone. It comes from purity, processing method, and buyer acceptance.

What Jojoba Oil Is Actually Used For Worldwide

- Cosmetic and Skincare Industry

This is the largest global demand segment.

Jojoba oil is used in:

Facial moisturizers

Anti-aging serums

Acne-control formulations

Sunscreens

Makeup removers

Lip balms

The reason cosmetic companies prefer jojoba oil is not marketing. It is performance. Jojoba oil:

Absorbs without clogging pores

Does not oxidize easily

Remains stable across temperature ranges

Does not require synthetic stabilizers

Many global brands use jojoba oil as a base carrier, even when it is not highlighted on the label.

- Hair Care Products

In hair care, jojoba oil is valued for scalp compatibility.

It is commonly used in:

Anti-dandruff formulations

Hair growth serums

Leave-in conditioners

Damage repair products

Unlike heavier vegetable oils, jojoba oil does not coat the scalp aggressively. This makes it suitable for long-term use in professional formulations.

- Pharmaceutical and Medical Applications

In pharmaceutical use, jojoba oil is valued for:

High skin tolerance

Non-reactive behavior

Long shelf stability

It is commonly used in:

Ointments

Dermatological creams

Healing balms

Transdermal carrier systems

Medical buyers are extremely sensitive to contamination, oxidation, and processing methods. Only cold-pressed, cosmetic or pharma-grade oil is accepted.

- Aromatherapy and Essential Oil Blending

Jojoba oil is one of the most preferred carrier oils for essential oils because:

It does not evaporate

It does not turn rancid

It does not alter fragrance chemistry

This niche market may appear small, but it consistently pays premium prices.

Global Jojoba Oil Prices (USD Reality)

Prices vary based on grade, purity, volume, and buyer segment.

Bulk International Prices (USD)

Industrial grade: $35 – $45 per kg

Cosmetic grade (cold-pressed): $50 – $75 per kg

Pharma-grade (tested, certified): $80+ per kg

These are factory gate or exporter-level prices, not retail.

Retail Market Prices (Consumer Packs)

30 ml bottle: $6 – $12

50 ml bottle: $12 – $20

100 ml bottle: $25 – $40

Retail pricing depends heavily on branding, packaging, and trust.

Why Jojoba Oil Is Often Rejected by Buyers

Many producers assume that if oil looks clear, it will sell. That assumption causes losses.

Common rejection reasons include:

Oil extracted using heat or chemicals

High moisture content

Oxidation during storage

Plastic container contamination

No lab test report

Mixed or diluted oil

In global trade, appearance does not replace analysis. Buyers test first, then talk price.

Cold-Pressed vs Chemically Extracted Oil

Cold-pressed jojoba oil:

Retains wax ester structure

Has higher buyer acceptance

Suitable for cosmetics and pharma

Chemically extracted oil:

May increase volume

Loses cosmetic compatibility

Rejected by premium buyers

Short-term gains from chemical extraction usually result in long-term market exclusion.

The Real Profit Difference: Seeds vs Oil

Selling jojoba seeds generates income, but not business-level returns.

When seeds are processed into oil:

Value multiplies

Buyer base expands

Export becomes possible

This is why most profitable jojoba operations globally are integrated producers, not raw sellers.

Shelf Life and Storage Reality

One reason jojoba oil is globally traded is its stability.

Properly stored jojoba oil:

Lasts 3 to 5 years

Does not require refrigeration

Maintains chemical structure

Improper storage destroys this advantage. Stainless steel or dark glass is not optional. It is mandatory.

Who Jojoba Oil Is NOT Suitable For

Jojoba oil is not suitable for:

Short-term income seekers

Low-quality mass oil producers

Traders without processing control

Sellers relying on verbal buyer promises

It is a long-cycle, quality-driven product.

Who Succeeds in the Jojoba Oil Business

Successful producers usually share three traits:

Control over processing

Understanding of buyer standards

Patience to build credibility

The market rewards consistency, not volume spikes.

Final Market Verdict

Jojoba oil is not expensive by accident.

Its price reflects:

Chemical compatibility with human skin

Processing sensitivity

Limited global supply

High rejection cost

For those who treat it as a commodity, margins collapse.

For those who treat it as a precision product, margins expand.

Frequently Asked Questions

Is jojoba oil edible?

It is not used as a food oil due to its wax ester structure.

Why is jojoba oil more expensive than other oils?

Because it replaces multiple synthetic ingredients in formulations.

Can small producers sell internationally?

Yes, but only with lab-tested, cosmetic-grade oil.

Does organic certification matter?

It helps in retail branding but does not replace quality testing.

✍️Farming Writers Team

Love farming Love Farmers.

Read A Next Post 👇

https://farmingwriters.com/avocado-oil-farming-reality-check/

Leave a ReplyShare your thoughts: We’d love to hear your farming ideas or experiences!