1. Introduction — Why Goat Milk Matters Globally

Goat milk has been a human food source for millennia and is resurging globally because of its distinct nutritional profile, digestibility, and suitability for small-scale sustainable farming. Unlike cow milk, goat milk is naturally homogenized (smaller fat globules), often easier to digest, and widely used in specialty cheese production. Rising consumer interest in natural, minimally processed foods, plus growing markets for specialty cheeses and infant nutrition formulations, has made goat milk a lucrative niche with both smallholder and industrial opportunities.

This guide gives a world-level, practical, and original analysis: goat breeds, milk composition, proven health benefits, production systems (smallholder to commercial), processing and value addition, USD profit estimates, global market demand and export potential, plus actionable recommendations for farmers, processors and entrepreneurs.

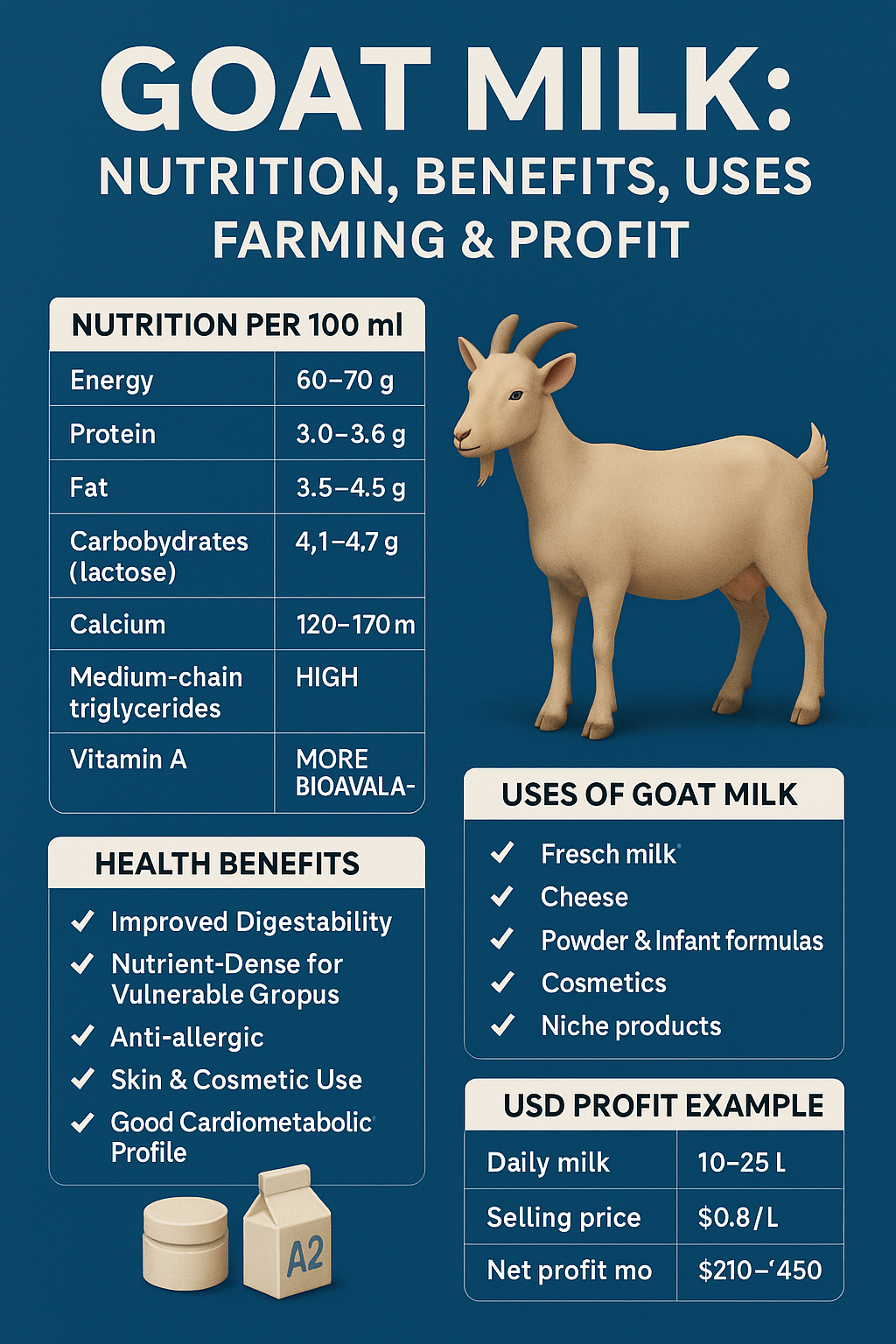

2. Goat Milk: The Nutrition Snapshot (Per 100 ml)

Goat milk composition varies by breed, feed, lactation stage and region. Below is an average composition useful for product planning.

Energy: 60–70 kcal

Protein: 3.0–3.6 g (complete proteins including essential amino acids)

Fat: 3.5–4.5 g (smaller fat globules, easier to digest)

Carbohydrates (Lactose): 4.1–4.7 g (slightly lower than cow milk)

Calcium: 120–170 mg

Phosphorus: 90–110 mg

Vitamin A: higher bioavailable content vs cow milk

Medium-chain triglycerides (MCTs): present in higher amounts → quick energy and easier digestion

Oligosaccharides & prebiotic components: beneficial for gut microbiome

Why these numbers matter: Higher MCT levels and smaller fat globules give goat milk clinical advantages for infant formulas, geriatric nutrition and digestive sensitivity markets. Protein content supports cheese yield and high-value dairy products.

3. Proven Health Benefits — Evidence-Backed Summary

3.1 Improved Digestibility

Goat milk’s small fat globules and higher MCTs break down more readily, so many people with minor lactose intolerance or milk sensitivity tolerate goat milk better. Several clinical studies show reduced digestive discomfort compared to standard cow milk in sensitive populations.

3.2 Nutrient Density for Vulnerable Groups

Because of bioavailable calcium, phosphorus and A-vitamin, goat milk supports bone health in children and older adults. It is also used in re-feeding and therapeutic nutrition in regions where fortified options are limited.

3.3 Anti-Allergic & Immune Modulation (Emerging Evidence)

Some studies report lower allergenic reactions (especially in case of cow milk protein allergy). Goat milk contains oligosaccharides and peptides that may modulate gut immunity — useful for infant formula R&D and therapeutic foods.

3.4 Skin & Cosmetic Uses

Goat milk’s natural fats and vitamins are effective in moisturizers, mild soaps and dermatological preparations. Historical and modern cosmetic brands use goat milk for sensitive skin formulations.

3.5 Cardiometabolic Profile

While saturated fats exist, the presence of MCTs and favorable fatty-acid balance in some breeds suggests a neutral-to-beneficial effect on energy metabolism when consumed in balanced diets.

Note: Consumers and regulators expect claims supported by local regulations (EFSA, FDA). For marketing, phrase benefits accurately: “supports digestion” or “naturally easier to digest for many individuals” rather than absolute medical claims.

4. Global Uses & Value-Added Products

4.1 Fresh Milk & Fluid Dairy

Direct bottled goat milk is a premium product in urban markets and health stores. Pasteurized, UHT and chilled forms target different retail channels.

4.2 Cheese & Fermented Dairy (Main Value Driver)

Fresh cheeses: chèvre, labneh, paneer-like products

Aged cheeses: Feta (often sheep + goat blends), Manchego-style blends, artisan goat cheeses — high price per kg

Yogurts & kefir: probiotic-rich fermented products

Cheese yields per liter of goat milk are strong for specialty cheeses; artisan brands command high margins.

4.3 Powder & Infant/Nutrition Formulations

Goat milk powder and hydrolyzed goat proteins are used in specialized infant formula segments (where regulations permit) and elderly nutrition.

4.4 Cosmetics & Pharma Excipients

Soaps, lotions and therapeutic creams using goat milk attract premium consumers seeking natural ingredients.

4.5 Direct Niche Products

A2-like goat milk segments (marketing as easy-digest)

Organic & grass-fed goat milk products

Ethnic dairy products for diaspora populations

5. Top Goat Breeds for Milk Production (World Overview)

Different regions use breeds that match climate, management and market goals.

High-Yield Commercial Breeds

Saanen (Switzerland) — large white goats, high milk volume (3–4 L/day average per mature doe under good conditions).

Toggenburg (Switzerland) — consistent yield, good solids.

Alpine (France/Alps) — versatile, strong yields.

LaMancha (USA developed) — good milking and temperament.

Climate-Adapted & Dual-Purpose Breeds

Nubian (Anglo-Nubian) — high butterfat (good for cheese & cream).

Boer — primarily meat, but crossbreeding used for dual purpose in some regions.

Indigenous/Local High-Value Breeds (important for regions)

Jamunapari & Beetal (India/Pakistan) — large, decent milk yield in local systems.

Murciana-granadina (Spain) — hardy and used in Mediterranean cheese production.

Kiko / local feral varieties (NZ/Pacific) — adaptable and low input.

Breed choice impacts: yield, milk solids (cheese yield), fat content (product match), and resilience to local disease/climate.

6. Production Systems — From Smallholder to Commercial

6.1 Smallholder / Pastoral Systems (Low Input)

Typical in Africa, South Asia, parts of Latin America.

Herd sizes: 2–20 does.

Feeding: grazing, crop residues, seasonal supplementation.

Milking: hand milking; milk sold locally or processed at small collection centers.

Advantage: low capital, local markets.

Challenge: lower yields, seasonal variability, disease control.

6.2 Semi-Intensive Systems

Herd sizes: 20–200.

Mixed grazing + cut fodder + concentrate supplementation.

Milking: manual or small machine parlours.

Opportunity: cooperatives collect, small cheese plants can be established.

6.3 Commercial & Industrial Goat Dairy

Herd sizes: 200–2000+.

Highly managed feeding (TMR, formulated concentrates), veterinary programs, machine milking (parlours or automated systems), on-farm pasteurization and value addition.

Target: urban retail, export grade products and industrial powder/cheese.

Sustainability note: goats often convert marginal lands and browse well; well-managed goat dairies can be low impact if erosion and overgrazing are controlled.

7. Farm Setup & Best Practices (Actionable Checklist)

7.1 Housing & Welfare

Well-drained, ventilated pens with bedding.

Separate kidding pens.

Shade and shelter from extremes.

7.2 Nutrition & Feeding

Fresh forage (legume + grass mix), conserved fodder (hay, silage), concentrate for lactation.

Mineral blocks (Se, Cu, Co where deficient).

Clean water always.

7.3 Breeding & Genetics

Use proven sires for improved milk solids.

Record keeping: births, lactation yields, disease events.

Consider AI and controlled breeding for scaling quality.

7.4 Health & Biosecurity

Vaccination schedule (per country guidelines).

Regular deworming, mastitis monitoring.

Sanitation during milking — post-milking teat dipping.

7.5 Milking & Milk Handling

Clean milking area, pre-milking teat cleaning.

Rapid cooling to 4°C to prevent spoilage.

Pasteurization if selling off-farm or value adding.

7.6 Recordkeeping & Economics

Track feed costs, milk yield per doe, veterinary costs, processing and packaging expenses.

Use basic farm accounting to model business scenarios.

8. Processing & Quality Standards

8.1 On-Farm Minimal Processing

Chilling, microfiltration, small pasteurization units; sells to local markets or small processors.

8.2 Small-Scale Cheese Processing

Starter cultures, brining, ripening rooms.

Hygiene and traceability protocols are critical for export or high-value markets.

8.3 Powder & Formula Facilities

Requires industrial drying plants, strict HACCP, regulatory approvals (especially for infant nutrition).

8.4 Labelling & Certifications

Organic, grass-fed, PDO (protected designation) or other origin labels increase price.

Comply with local milk standards (fat, solids, microbial counts).

9. Global Market Demand & Trends (2025–2030 Outlook)

9.1 Market Drivers

Urbanization & premiumization — artisan goat cheese and specialty dairy.

Health & wellness — goat milk positioned as “easier to digest.”

Ethnic foods and diaspora demand in Europe and North America.

Cosmetic industry demand for goat milk based soaps and creams.

Organic & small-batch artisanal brand growth.

9.2 Regions of Rising Demand

Europe & North America: artisan cheese, specialty milk, organic segments.

Asia (China, SEA): growing interest in infant and therapeutic nutrition; niche market for goat milk products.

Middle East: pasteurized and concentrated goat milk products.

Africa & South Asia: local consumption remains primary; premiumization is emerging.

9.3 Price & Export Considerations

Goat milk per liter price varies widely: $0.6–$1.8/L depending on region and product.

Cheese and powdered goat milk bring higher export values; artisan cheeses can reach $10–$30+ per kg retail.

10. USD Profit Analysis — Realistic Example Models

Below are average models (figures indicative; adjust for local feed and labor costs). Use these to plan capital and cashflow.

Model A — Smallholder (10 lactating does)

Average yield/doe: 1.5–2.5 L/day (varies by breed & feed)

Total daily milk: 15–25 L

Selling price (raw farmgate): $0.8/L (regional average)

Daily revenue: $12–$20

Monthly revenue: $360–$600

Monthly costs (feed, labor, vet): $150–$300

Net monthly profit: $210–$450

Key profit levers: improve feed to boost yield, direct sales to consumers/shops to capture higher margins.

Model B — Semi-commercial (100 lactating does)

Avg yield/doe: 2.5–3.5 L/day

Total daily milk: 250–350 L

Processing & value add: make cheese/yogurt — value uplift 2–5x over raw milk revenue

Estimated monthly net (after costs & processing): $6,000–$20,000 depending on product mix and market

Model C — Commercial (500+ does + processing)

Scale benefits: contracts with retailers, export-ready cheese/powder lines.

Profitability: higher per unit margins after initial capital amortization; exact figures depend heavily on CAPEX.

Important: value addition (cheese, powder, cosmetics) multiplies profit far beyond raw milk sales.

11. Risks & Challenges

Seasonality — milk yield fluctuates with feed availability.

Disease — mastitis, parasitism, reproductive issues impact yields.

Supply chain — cold chain gaps reduce quality and price.

Regulatory — export requirements for infant nutrition and powdered products are stringent.

Market competition — artisan cheese markets are crowded; differentiation matters.

Mitigation: herd health programs, feed planning, cooperatives for collection and shared processing, certifications (organic/PDO) and strong branding.

12. How to Start: Practical 6-Month Plan (Step-by-Step)

Month 1 — Planning & Site Setup: choose breed, secure land/shelter, plan water and feed sources.

Month 2 — Acquire Herd & Start Records: buy quality does and one proven buck or AI services; set up record keeping.

Month 3 — Feeding & Health Regimen: implement feeding plan, vaccination, mineral supplementation.

Month 4 — Milk Handling & Market Linkages: procure chilling tanks, contact local buyers, test milk quality.

Month 5 — Small-Scale Value Addition: pilot yogurt/cheese production, set packaging and labeling.

Month 6 — Scale & Marketing: finalize supply contracts, launch direct sales/online presence, apply certifications if pursuing premium markets.

13. Marketing & SEO Tips for Goat Milk Products (Practical)

Emphasize “easier to digest” and “artisan/organic” tags where justified.

Use content marketing: recipes, health articles, farmer stories.

Target diaspora and specialty food retailers via export shows and trade platforms.

Optimize product pages for searches: “goat cheese near me”, “buy goat milk powder”, “goat milk for sensitive stomach” and long-tail queries.

Use high-quality photos and transparent lab reports to build trust.

14. Conclusion — Why Goat Milk Is a Smart Farming & Business Choice

Goat milk bridges smallholder accessibility and premium product opportunities. It fits both sustainable, low-input farming and high-margin artisan processing. With rising global demand for specialty dairy and health-oriented foods, goat milk offers diversified revenue streams: fresh milk, cheese, powder, cosmetics and niche infant/therapeutic nutrition. For farmers and entrepreneurs who apply good breeding, nutrition and processing discipline, goat dairying can be both resilient and profitable.

15. Frequently Asked Questions (FAQs)

Q1: Is goat milk better than cow milk?

A1: “Better” depends on purpose. Goat milk is often easier to digest and better for certain cheese types; cow milk yields more volume and suits mass markets. For premium niche, goat milk often performs better.

Q2: Can goat milk be used for infant formula?

A2: Some regions permit goat-milk-based formulas; regulatory approvals are needed. Formulations must meet strict nutritional and safety standards.

Q3: What is the average lifespan and productive life of a dairy doe?

A3: Many does produce well for 3–6 lactations (3–6 years). Good management can extend productive life.

Q4: How much land is needed per doe?

A4: Depends on system. Extensive grazing needs more land; semi-intensive systems with cut-and-carry require less. Typical smallholder allotment: 0.05–0.2 hectare per goat for fodder rotation, but intensive systems can operate with far less.

Q5: How to increase cheese yield?

A5: Improve milk solids via nutrition, choose breeds with higher total solids (fat + protein), and optimize cheese recipes and processing efficiency.

✍️Farming Writers

Love farming Love Farmers

Read A Next Post 👇

https://farmingwriters.com/buffalo-milk-global-guide-nutrition-benefits-profit-market-demand/